Portland is a PR machine for light rail & streetcar

Here are Some Facts About Portland Oregon

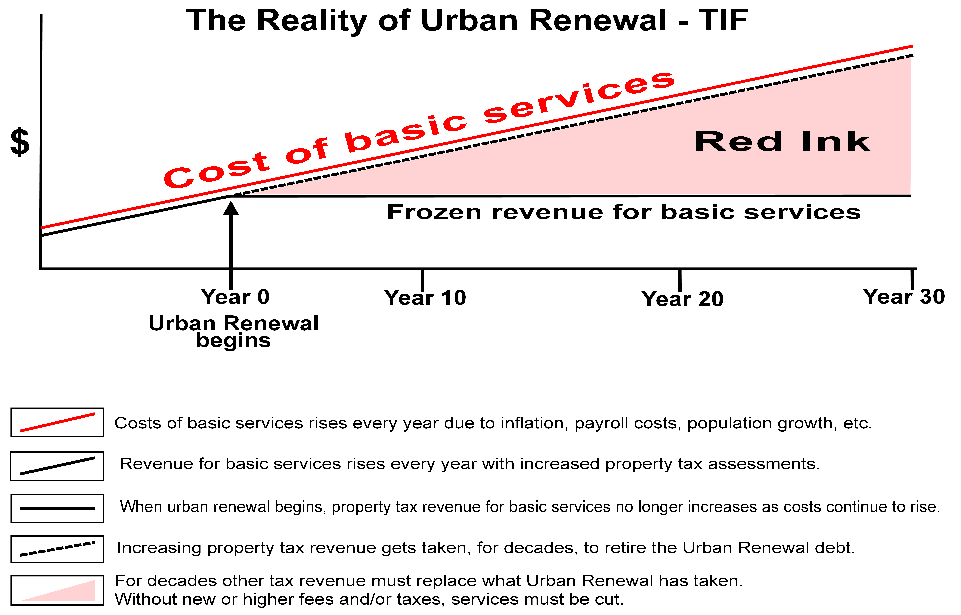

The Real Price of Urban Renewal

What is Tax Increment Financing?

In theory, urban renewal is relatively simple. By incurring debt to pay for public improvements within a specific “plan area”, it is expected that property values will increase due to private investments that would not otherwise occur. This new value is called “increment” or “excess value”. The property taxes from this increase in value is then given to the urban renewal agency to pay off the debt. Revenue generated in this manner is referred to as “tax increment financing” (TIF) or “division of tax revenue”. If there is no increase in assessed value, the urban renewal agency does not collect any revenue. Local taxing districts, such as the county, city, school district, fire district and others, continue to receive the property taxes from the assessed value the district had before the urban renewal plan area plan was formed. This value is called the “frozen value”. (Bold added, from page 45 of the 2006-2007 TSCC report.)

Where Would the Money Have Gone?

Above chart composed from data on page 30 of PDC's Annual Urban Renewal Report Covering Fiscal Years 2005-06 and 2006-07 (Interestingly, Multnomah County lists the total PDC UR money at $73.5 million, not $51.2 million, on page 47 of the 2006-2007 TSCC report : The total amount imposed for PDC, $73,547,737, represents more than 98.3% of the total urban renewal taxes imposed in Multnomah County for 2006-07.) (Clackama County-see page 5 of this)

See Pages 45-54 of the 2006-2007 Annual report of theTax Supervising & Conservation Commission

|

Jurisdiction City of Portland Multnomah County Portland School District others

Total of all TIF

|

Dollars $20.6 million $13.8 million $11.4 million $5.4 million

$51.2

|

|

Percentage 40% from City services 27% from County services 22% from Portland's schools 11% from other services

100%

|

Experts say that about 35 percent of the taxes within an urban renewal district would normally go to schools. Oregonian, February 28, 2010 (local)

But We wouldn't have received that money if it wasn't for the PDC's investment!

1) Over the years property increases in value, but the "frozen value" does not change to reflect this, ALL of the normal increased value of existing property is given to the TIF.

2) The new buildings, and their residents, in the UR areas all consume services, but ALL of their taxes go to the TIF, not to pay for the city or county services used by the new buildings and their residents. The rest of the city's residents have to pay more, or get less services, to make up the difference. Only the raw land and old building taxes (without appreciation) still go the basic services.

3) An urban renewal district can last 25 years and issue 20 year bonds on its last day of existence, so it can take 45 years for all of the tax money to finally reach basic government services. (Just about in time for the area to become run down again and require a new cycle of urban renewal.)

4) For the first 20-45 years, the UR area may require more in services than it pays in taxes (especially if the area started out as vacant land). After 45 years the UR area should be paying more in taxes that it gets in services. This small tax surplus above the cost of services is the amount that should go to pay the deficit built up over the years of underpaying for services. The question is how many years, starting 45 years out, will it take to break even? The answer: no one seems to have calculated it (or will admit to calculating it)!

We strongly suspect that the debt will NEVER be repaid, leaving the city with a NET LOSS for having created an urban renewal district. But,in most areas, the politicians will get generous campaign contributions from those that profit from urban renewal.

Do Tax Increment Finance Districts in Iowa Spur Regional Economic and Demographic Growth?

THE EFFECTS OF TAX INCREMENT FINANCING ON ECONOMIC DEVELOPMENT

Giving Away the Store to Get a Store

Eliminating Subsidies for Big Business

Tax Increment Financing: A Tool for Local Economic Development

How much does urban renewal hurt other services?

In the 2009-2010 fiscal year, $182 million was diverted from various districts to urban renewal in Oregon. Public education alone lost $62.7 million in potential revenue because of urban renewal activity. Cities lost $58 million in that fiscal year, and counties lost $37.8 million – including $24 million by Multnomah County.

The two taxing districts hurt most by urban renewal last year were community colleges and fire districts, which lost $6 million and $5.6 million, respectively

(bold added)

Read the whole story at the Daily Journal of Commerce

http://djcoregon.com/news/2010/08/11/in-oregon-a-stand-against-urban-renewal/